Reducing your compliance risk: we provide e-Invoicing compliance in 69 countries and clearance in 12

- It’s our customers’ number 1 issue

- Don’t risk fines and repetitional damage

- Act now to beat the deadlines

69

e-invoicing

compliance countries covered

12

clearance

countries covered

PA

registered

in France

We've got you covered

Our global

compliance

coverage

Boost efficiency and reduce costs with Tradeshift’s proven Compliance-as-a-Service solution.

Our global e-Invoicing compliance process helps businesses seamlessly meet mandatory e-invoicing and tax clearance mandates, ensuring full regulatory compliance.

e-Invoicing compliance: why Tradeshift

Out-of-the-box

compliance

Out-of-the-box compliance solutions in 69 countries including 12 clearance countries

We’re PA

immatriculée

Among the first to achieve registered Plateforme Agréée (PA immatriculée) status in France.

Cross-zone

China e-Invoicing

Unique cross-zone fapiao e-Invoicing capabilities in China

Tradeshift for Belgium compliance:

we offer 2 solutions

- Belgium deadline is 4 months away

- We’ve been a Peppol access point since 2014

- We offer 2 solutions depending on your requirements

Which solution is best for your company?

Specifically for the Belgian market, we offer two solutions for e-Invoicing compliance: Tradeshift and Babelway.

(Tradeshift owns Babelway).

Babelway is the do it yourself option and best if you’re:

- Looking for e-Invoice compliance in Belgium only

- You’re a small or medium-sized business

- You’re happy to set up yourself (it’s easy!)

For Babelway, you can either contact Babelway’s sales team or go straight into a free 30-day trial.

Tradeshift is the full service option best if you are:

- Your e-Invoice compliance needs are multi-country

- You are a large or an enterprise company with global operations

- You have a complex setup (e.g., requires integration with one or more ERP)

- You have complex AP requirements (e.g,. you need auto routing of invoices).

Tradeshift PA: your first choice for electronic invoicing

- One of the first companies to obtain PA status

- 15 years of experience in France

- Extensive experience in electronic invoicing and compliance

- Experts in supporting large companies with complex international compliance needs

e-Invoicing compliance in focus: trending countries

Click on the icons below for more country-specific insight on tax and e-Invoicing regulations. Stay up to date on regulatory changes, get practical advise from our experts and learn more about how Tradeshift can help you stay compliant.

e-Invoicing mandates are sweeping the globe.

What’s your plan?

Our comprehensive guide on how to stay compliant.

Compliance Resources

See all Compliance resourcesLess than a year to go before electronic invoicing becomes mandatory

The 2026 deadline is approaching: are you ready? Join us for an interactive session with Tradeshift experts to discover feedback, technical updates, practical advice, and a strategic vision for the future.

Germany’s new multilingual e-Invoicing flexibility: A strategic advantage for global business

Germany's B2B e-invoicing now allows all EU languages (2025). See how this multilingual flexibility boosts global trade. Choose Tradeshift: your 26-language compliance partner.

Poland’s B2B e-Invoicing mandate: Get ready now for February 2026

Poland's KSeF e-invoicing mandate starts February 2026. With the new KSeF 2.0 manual and November testing, learn what large taxpayers need to know about the official timeline, FA(3) XML format, and how to ensure compliance.

Belgium’s B2B e-Invoicing mandate: The countdown to January 2026

Learn about Belgium's 2026 B2B e-invoicing mandate and how to prepare. Our guide covers Peppol requirements, future e-reporting, and how Tradeshift helps businesses achieve compliance.

e-Invoicing compliance around the world - explore our comprehensive list of country profiles

Argentina

Australia

Austria

Bahrain

Belgium

Brazil

Bulgaria

Canada

Chile

China

Colombia

Costa Rica

Croatia

Cyprus

Czech Republic

Denmark

Egypt

Estonia

Finland

France

Germany

Greece

Hong Kong

Hungary

Iceland

India

Ireland

Italy

Japan

Latvia

Lithuania

Luxembourg

Malaysia

Mexico

Morocco

Netherlands

New Zealand

Norway

Peru

Poland

Portugal

Romania

Saudi Arabia

Singapore

Slovakia

Slovenia

South Africa

Spain

Sweden

Switzerland

Turkey

United Arab Emirates

United Kindgom

United States

e-Invoicing Compliance FAQs

e-invoicing compliance refers to specific adherence to legal, regulatory, and technical requirements for electronically exchanging invoices between buyers and suppliers.

Each country has its requirements in the aspect of formats in place, transmission methods, or accurate data being used.

Many governments require e-Invoicing in order to enhance tax reporting, reduce fraud, and make business processes more efficient.

Businesses are often required to use platforms that comply with local regulations, such as support for structured invoice formats, like XML or UBL, digital signatures, and real-time invoice validation with tax authorities.

Traditionally, many countries use a post-audit model for B2B transactions, where invoices are exchanged between sellers and buyers and reviewed by tax authorities later.

Businesses must keep proof of invoice accuracy for up to ten years, as audits may occur long after transactions.

While paper and PDF invoices are common, some businesses also engage in voluntary e-invoicing for VAT compliance.

In contrast, clearance models require tax authorities to validate invoices before they reach buyers, ensuring adherence to regulations.

Vendors must submit transaction data to a tax authority platform around the invoicing time, giving authorities real-time insights into transactions.

Continuous transaction controls can be centralized, where suppliers send e-invoices through a tax authority system, or decentralised, allowing direct e-invoicing to buyers while reporting data to tax authorities.

PEPPOL is an infrastructure and a network for exchanging electronic business documents relating to e-commerce and e-procurement.

Created in 2008 as an EU project by the European Commission, the aim was to facilitate the development of e-commerce in Europe.

Later, it evolved into a global network of service providers and national government authorities, forming the non-profit “OpenPEPPOL” organisation under Belgian law. PEPPOL is in use in 31 countries in Europe plus Australia, Canada, New Zealand, Singapore, South Africa, and the United States. OpenPEPPOL has Certified Access Points in 29 European countries plus Australia, Canada, New Zealand, Singapore, and the USA.

Tradeshift is one of the founding members of the OpenPEPPOL organization and uses its artefacts and specifications to enable cross-border e-procurement and e-invoicing.

Implementing a Peppol-compliant solution like Tradeshift’s e-Invoicing platform allows businesses to ensure seamless and compliant invoice exchanges in any Peppol-enabled market.

This reduces the risks and complexities associated with international e-Invoicing.

Tradeshift has a proven process for delivering compliance-as-a-service, and provides customers such as AirFrance, Disneyland Paris, Schaeffler with innovative solutions that support their digital transformation journey and ensure they comply with e-invoicing and tax clearance mandates.

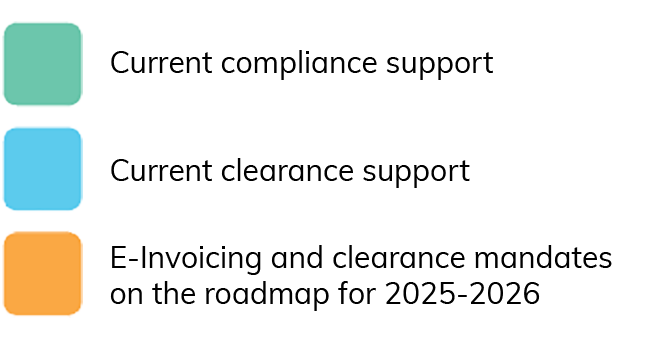

We currently offer compliance-as-a-service for 69 countries, including a streamlined process for complying with tax clearance mandates in 12 countries and e-Invoicing mandates.

Examples of countries with tax clearance or B2B e-invoicing mandates that we support are Malaysia, France, Romania, and Germany with other European and APAC countries such as Australia on our roadmap.

To ensure compliance excellence, we continually evaluate emerging global regulations and prioritise the inclusion of additional countries in our roadmap.

We’re also the only company offering cross-zone fapiao e-invoicing capabilities in China and among the first to become a registered PA (PA immatriculée) in France.

We offer compliance-as-a-service in 69 countries, out of which 12 countries use a clearance system.

The current list of clearance countries supported by Tradeshift is as follows:

- Chile

- China

- Colombia

- Costa Rica

- Poland

- India

- Italy

- Malaysia

- Mexico

- Peru

- Romania

- Turkey

Our flexible platform can adapt to any clearance and e-Invoicing compliance needs, mandated by local governments.

Our 2025 – 2027 roadmap includes support for e-Invoicing and clearance mandates in:

- Germany

- France

- Poland

- Spain

- Australia

- Belgium

As a registered PA (formerly known as PDP), Tradeshift is fully equipped to help businesses operating in France make a smooth transition to tax and e-Invoicing regulations due to come into effect from September 1st 2026.

Tradeshift currently offers compliance-as-a-service for 69 countries, including a streamlined process for complying with tax clearance mandates in 12 countries and e-Invoicing mandates.

See below for the full list of countries where Tradeshift currently supports compliance:

- Argentina (Clearance services are not currently available, compliance rules can be requested and scoped in a Statement of Work.)

- Australia

- Austria

- Bahrain

- Belgium

- Botswana

- Brazil (Clearance services are not currently available, compliance rules can be requested and scoped in a Statement of Work.)

- Bulgaria

- Canada

- Chile

- China

- Colombia

- Costa Rica

- Croatia

- Cyprus

- Czech Republic

- Denmark

- Ecuador

- Estonia

- Finland

- France

- Germany

- Ghana

- Greece

- Hong Kong

- Hungary

- Iceland

- Indonesia (Clearance services are not currently available, compliance rules can be requested and scoped in a Statement of Work.)

- India

- Ireland

- Israel

- Italy

- Japan

- Kenya

- Latvia

- Lithuania

- Liechtenstein

- Luxembourg

- Malaysia

- Mauritius

- Mexico

- Monaco

- Morocco

- Netherlands

- New Zealand

- Norway

- Pakistan

- Peru

- Poland

- Portugal

- Puerto Rico

- Romania

- Rwanda

- Saudi Arabia (Saudi Arabia has entered the second phase of its e-invoicing rollout, extending requirements to the 24th group of taxpayers between from June 30, 2026. As a clearance country, API development with Sovos is under analysis. Meanwhile, we continue to support BFR compliance rules for taxpayers not yet covered by the mandate.)

- Singapore

- Slovakia

- Slovenia

- South Africa

- Spain

- Sweden

- Switzerland

- Thailand

- Tunisia

- Turkey

- Uganda

- United Arab Emirates

- United Kingdom

- United States

- Uruguay