e-Invoicing compliance.

Seamless efficiency, global coverage

Tradeshift’s modern and intuitive e-Invoicing solution captures 100% of your invoices electronically, integrates seamlessly with your existing finance systems, and ensures compliance with e-Invoicing regulations worldwide.

Watch how we tackle e-Invoicing

mandates across the world

Explore how Tradeshift simplifies compliance with country-specific regulations. Watch these short demos to see how our solution ensures complete adherence to local mandates. Click on an image to watch a demo.

French compliance

German Compliance

with Tradeshift

Romania compliance

Malaysia compliance

We help our global customers unlock the total efficiency and cost-saving potential of mandatory e-Invoicing

15

years

helping businesses

transform AP

$240

billion

digital transactions

processsed

1

million

suppliers onboarded

with Tradeshift

70

countries

covered with e-Invoicing compliance

We’re fully international in our solutions, operations, customer support, and e-Invoicing compliance coverage

Transform your invoicing process with Tradeshift

Easy supplier onboarding

Accelerate e-Invoicing adoption with First Invoice Onboarding—get suppliers onboard instantly without any complex setup, so you start benefiting from day one.

100% electronic invoice capture

Capture 100% of your invoices electronically and eliminate manual tasks. Every invoice is automatically validated, matched, and made ready for seamless approval.

Seamless Integration

Integrate with any ERP or accounting system without compromising your unique processes—Tradeshift adapts to your needs, not the other way around.

Day 1

transactions

digitally with

your suppliers

90%

lower

transaction costs**

75%

faster invoice

cycle time**

2.15x

higher

straight-through

process rates

Tradeshift solves your biggest e-Invoicing challenges

Compliance complexities

E-Invoicing regulations are evolving rapidly, and non-compliance can lead to significant financial penalties and disruptions to your business.

Manual, error-prone

processes

Manual invoice processing is slow, inefficient, and prone to errors. Juggling different invoice formats (PDFs, emails, paper, EDI) leads to costly rework and delays in payment.

Low supplier

e-Invoicing adoption

Without widespread supplier participation, you won’t realize the full benefits of e-Invoicing — cost savings, faster processing, reduced errors, and improved efficiency.

Integration roadblocks

Complex integrations and scalability issues can hinder e-Invoicing implementation, delaying your ROI and disrupting your operations.

Globally compliant eInvoicing: How Tradeshift streamlines and automates the process

Global compliance-as-a service

- Global compliance, simplified: Our flexible platform is engineered to handle complex regulatory requirements worldwide. Our compliance-as-a-service capabilities cover over 70 countries including 12 Clearance countries.

- Future-proof compliance in France: As a registered PDP provider, we’re fully equipped for France’s 2026 e-invoicing mandate, supporting both inbound and outbound requirements.

- Unlock Peppol interoperability: As a certified Peppol Access Point, Tradeshift enables businesses to exchange e-invoices with any other company connected to the Peppol network, regardless of their e-Invoicing provider.

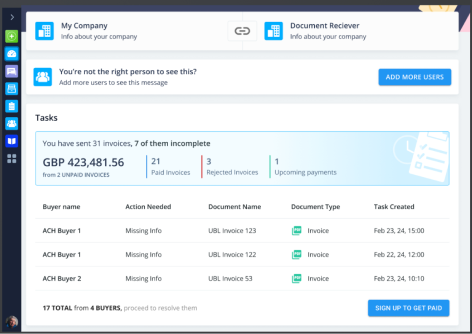

Effortless supplier onboarding

- Accelerate e-invoice adoption: With First Invoice Onboarding, you can start receiving e-invoices from your suppliers immediately—no complex setup is required.

- Empower supplier self-service: Give suppliers instant access to their transaction history, invoice statuses, and early payment options through embedded finance.

- Support key suppliers: Get dedicated integration support for high-volume and strategic suppliers to ensure seamless, automated invoice submission.

100% electronic invoice capture

- Make invoicing easy: Flexible submission options like direct integration, PDF upload, and PO-flip mean any supplier can submit e-invoices through Tradeshift, regardless of their size or technical capability

- Eliminate manual entry: Tradeshift automatically extracts structured data from any invoice, eliminating manual data entry and all associated paper processes.

- Ensure data quality: The Tradeshift Business Firewall automatically verifies invoice accuracy and completeness for seamless approvals, minimised errors, and flagging of duplicate or potentially fraudulent documents.

Integration any way you need

- Connect anything: Integrate any ERP, accounting system, or business tool. Tradeshift supports multiple protocols and formats for seamless and accurate data exchange without compromising governance or security.

- Accelerate deployment: Use prebuilt connectors for rapid integration with major systems like SAP, Oracle, and Netsuite.

- No need to compromise: Easily adapt Tradeshift to your unique workflows and processes, regardless of transaction volume or supplier network size.

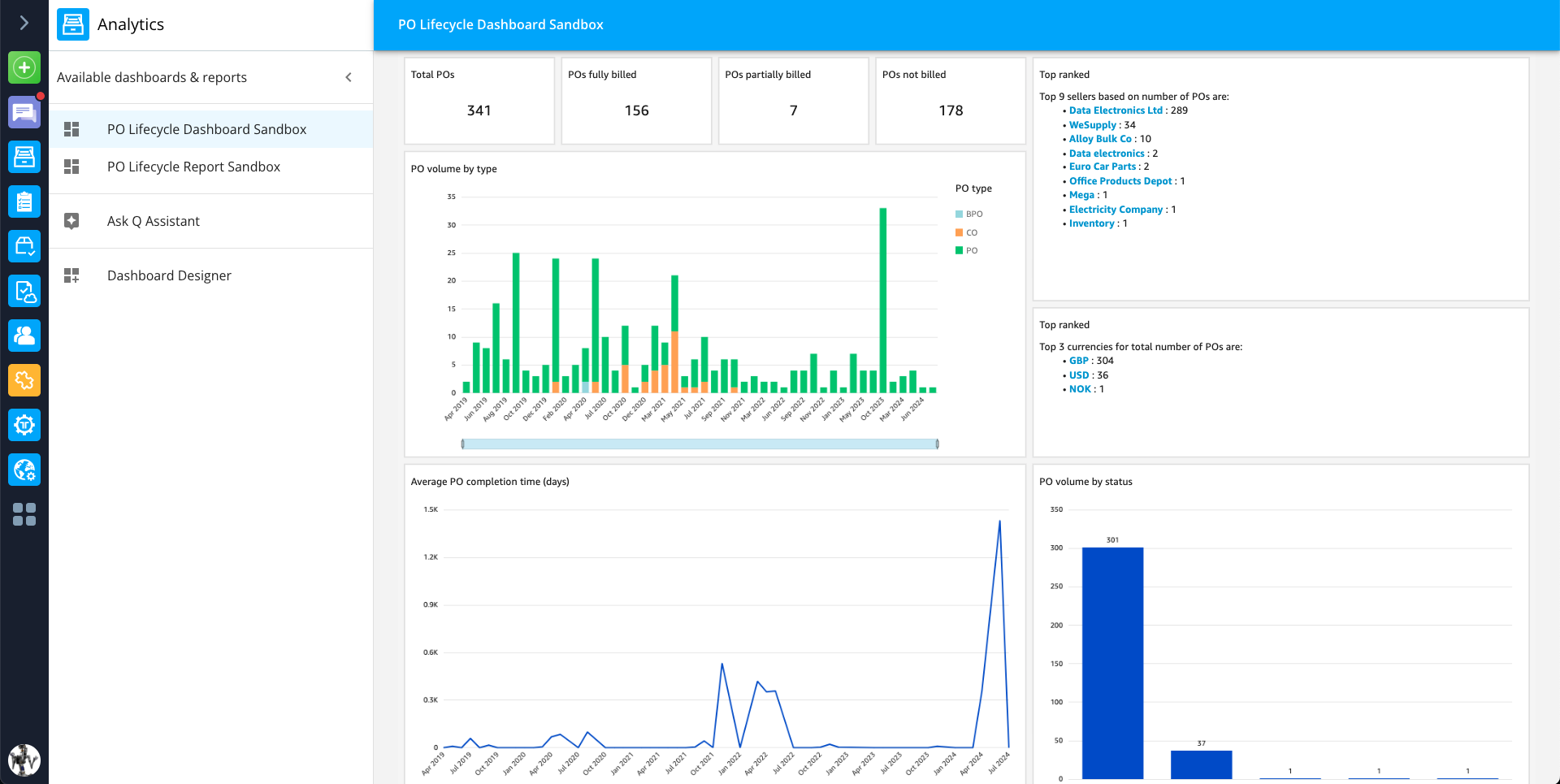

Complete visibility and control

- Track and manage documents: Tradeshift’s Document Manager lets buyers and sellers track documents with filters for status, type, date, sender, and recipient.

- Streamline task management: Tradeshift’s Task Manager lets you manage workloads, filter tasks by type or exception, and create workspaces for seamless vendor collaboration with a full audit history.

- Real-time analytics made simple: Tradeshift Analytics, powered by generative AI, eliminates complex integration. Instantly query data, build dashboards, and visualise results in real time.

Customer support rating

Star rating reflects quarterly customer survey results from buyers and suppliers on the Tradeshift network who submitted support queries.

What everyone is saying about Tradeshift

“Our vision was to standardise how we received digital documents across our entire supplier base.

Investing in this partnership and this project with Tradeshift was a good decision. We’ve found Tradeshift to be a very responsive partner.”

“We want to make sure that suppliers have a great experience.

For many of them, it’s a big change.

Really easy-to-use technology is a must, and that’s certainly what we get with Tradeshift.”

“The benefits of working with Tradeshift include freeing up your AP team to be more strategic by automating their more mundane tasks.

Tradeshift’s platform also help improve communication with suppliers and makes document handling more efficient and transparent.”

“Tradeshift is a very modern solution and that means you can adapt it to suit your business needs as you grow.

There are a lot of different applications available on the platform which we can use to enhance our way of working with suppliers and make it easier to process our invoices.”

Get started with globally compliant e-Invoicing today

See how Tradeshift’s globally compliant e-Invoicing solution can streamline your processes, eliminate manual tasks, and ensure accuracy from day one.

Schedule your personalised demo now and experience firsthand how Tradeshift can help your business save time, reduce errors, and accelerate growth.

e-Invoicing mandates are sweeping the globe. What’s your plan?

Our comprehensive guide provides everything you need to stay compliant.

Compliance Resources

See all Compliance resourcesFrance’s 2026 e-Invoicing mandate: What we learned in our compliance webinar

As France pushes forward with its nationwide e-invoicing and e-reporting mandate, our recent compliance webinar brought much-needed clarity to what…

Get ready now for e-invoicing in France

Watch our on-demand webinar on the latest developments in B2B electronic invoicing in France, and the progress of our PDP solution.

Tradeshift Spring Release Webinar 2025

Each Spring, our Product team releases a host of new features designed to optimize your experience on our network. Watch our customer-exclusive webinar to explore the latest enhancements available in our Spring 2025 Release!

France PDP e-Invoicing mandate: PDP Calendar February 2025 update

Choosing the Right Partner for E-Invoicing Compliance: Key Considerations As e-invoicing mandates and Continuous Transaction Controls (CTC) become the standard worldwide, businesses must prepare to comply with these new regulations.

e-Invoicing FAQs

E-invoicing offers several advantages over traditional paper invoicing, including:

Saving processing time: E-invoicing automates many of the tasks associated with invoicing, such as data entry and filing, which saves time for the accounts payable department.

Reducing errors: The automation and direct delivery to customers lessen the chances of invoices being lost or sent to the wrong location. The digital paper trail also makes tracking invoices more efficient.

Increasing ease of use: E-invoicing systems can integrate with other business tools and technologies, simplifying the management of invoices and payments. This can lead to faster payments to suppliers.

Enhancing record-keeping: Digital invoices are easier to store and organise and can be quickly accessed for reference, which is helpful for supply chain management and tax compliance.

Facilitating tax compliance: E-invoicing platforms automatically comply with localised regulations, making it easier to stay up-to-date with compliance requirements and streamline tax season preparations.

Tradeshift’s Business Firewall serves as an automated compliance layer for financial transactions.

It automatically verifies incoming financial documents, such as invoices and credit notes, against a bespoke set of rules configured by the recipient organisation.

These rules can be tailored to align with the organisation’s internal control requirements and procurement policies.

Documents that do not comply with these established rules are automatically blocked from progressing further in the system, and the supplier is prompted to amend the document accordingly.

It’s a way to automate checks and avoid problems before they happen, saving time and effort for everyone involved.

Tradeshift is designed for a smooth and straightforward setup. Here’s how we make it easy:

- Intuitive interface: Our platform has a modern and user-friendly interface that’s easy to navigate and configure.

- Guided onboarding: Our team provides personalised support throughout onboarding, ensuring a seamless transition.

- Automated setup: We handle the initial account setup and configuration, including setting up data validation rules to minimise errors.

- Minimal disruption: We work with you to create a custom implementation plan that fits your existing AP workflow, minimising disruptions to your operations.

- Supplier onboarding support: We assist in connecting and onboarding your suppliers, making it easy for them to start sending invoices digitally. Our “First Invoice Onboarding” feature lets suppliers begin the process by sending a PDF invoice to a dedicated email address.

- Dedicated support: Our supplier onboarding team and technical experts are available to answer questions and provide support throughout the process.

- Ongoing resources: Once you’re set up, you’ll have access to Tradeshift University for training and development and 365-day support for any questions or issues that may arise.

With Tradeshift, you can get started with AP automation quickly and easily, with minimal disruption to your business.

Tradeshift ScanIO is an application that allows you to receive invoices, credit notes, and other business documents from your suppliers through various channels, including scanning partners and value-added networks (VANs).

It seamlessly integrates these documents into the Tradeshift platform for efficient processing and management of your procurement transactions.

Key features:

- Multiple source support: ScanIO supports documents from traditional VANs (Peppol, NEMHANDEL, etc.), scanning partners, and BPO partners.

- TS:UBL format: The app accepts TS:UBL documents. Babelway or other interoperability partners handle conversions from different formats.

- Validation and correction: ScanIO validates documents and allows manual correction of errors.

- Internal collaboration: Facilitates collaboration between teams for efficient document processing.

In short, ScanIO simplifies the integration of business documents into Tradeshift, optimising your procurement transaction management.

We want to make submitting invoices through Tradeshift as simple and seamless as possible for suppliers, regardless of their size or technical capabilities.So we’ve designed the platform to accommodate a variety of different invoice submission methods that will help you reach your digitalisation goals quickly:

- Email and paper: Tradeshift Invoice Entry is a fully managed service where we act as your invoice entry team. Invoices sent to us as PDFs are digitised with high accuracy and input into your system. We can also integrate and process invoices from your existing digital mailroom or scanning service through ScanIO.

- WebUI: Suppliers sending a very limited number of invoices can use this free tool to quickly flip purchase orders into compliant e-invoices, or manually input invoices on their own.

- PDF 2 XML: Great for suppliers sending you more than 300 PDF-attached emails annually. Suppliers send their documents to a dedicated email address while you get the benefits of a fully digital invoice straight into your system.

- Connectors: Suppliers with smaller backend systems e.g Sage, Quickbooks, MS Dynamics, Tradeshift offers its own pre-built connectors through Tradeshift Link, our proprietary middleware.

- Direct integration: We offer a full integration service with any ERP for your most strategic/high-volume suppliers.

The Tradeshift platform is specifically engineered to help businesses streamline and automate the complexity of complying with an ever-expanding list of country-specific e-invoicing mandates and clearance (CTC) regulations.

Today, we support e-invoices in over 70 countries and 12 Clearance Countries. (Check out our compliance map to see the complete list of countries we support.)

Tradeshift has a proven process for delivering compliance, including meeting the complex needs of many countries adopting clearance models.

Tradeshift acquired Babelway in 2018, a leading cloud integration platform that underpins its customers’ integration and messaging needs. This acquisition provides the framework for Tradeshift to accelerate the rollout of new clearance needs.

Non-compliance with regulations comes with the potential of significant business and financial harm, including:

- Administrative fines

- Legal sanctions

- Protracted audits

- Loss of VAT rights

- Trading partner audits

The business risk of non-compliance goes beyond the threat of potential financial penalties.

Businesses that fail to take a proactive approach to deploying compliant solutions risk falling behind competitors whose ability to optimise workflows and avoid transaction delays will leave them in a prime position to win business.

A lack of systems and expertise to streamline compliance requirements can also prove a significant drain on internal resources, pushing the focus away from core business activities and innovation.

Tradeshift’s Document Manager is a central feature that helps you keep track of all your e-invoices once they are received.

It displays all documents sent and received via the Tradeshift platform, offering a comprehensive overview that includes document types, amounts, issue dates, and other relevant details.

The document list can be customised to show the information most relevant to you, and you can save frequently used filters for quicker access in the future.

Tradeshift’s advanced archiving capabilities allow for secure storage, making it simple to retrieve and manage your invoices for future reference.

Tradeshift maintains all documents and associated information for existing accounts for at least 10 years.

Companies can export data in three primary ways: CSV from the UI, from a Private Data Lake, or by integrating into our native APIs.

For countries where legal archiving is a requirement, we have pre-built integrations with 3rd party providers that meet the local requirements.

Tradeshift considers the customer data entrusted to us to be the lifeblood of our operations. We have built the platform and associated processes to reflect the critical nature of the documents and records we store and process.

As a baseline, we are audited against the major standards for information security, confidentiality and integrity – ISO 27001, SOC 1, SOC 2 and ISAE 3402.

Additionally, we have dedicated security and compliance teams to secure the infrastructure and ensure that platform components are designed and operated securely and consistently.

Our internal security programs heavily emphasise continuous improvement and defence in depth.

We are constantly looking for new ways to add additional layers of protection and detection capabilities across the platform, ensuring that our security posture meets the most stringent needs of even our regulated customers.