Romania e-Invoicing Changes 2024

Romania e-Invoicing Changes 2024

By Ioana Ploesteanu, Product Marketing Manager, Tradeshift

A Guide to e-Invoicing Clearance Mandates for Romania

The Romanian tax landscape is undergoing a significant transformation with the implementation of clearance mandates and the mandatory adoption of the e-Factura e-invoicing system. This new system, aiming for a more efficient and digitized tax environment, introduces several changes for businesses operating in the country. Understanding the changes to Romanian e-invoicing mandates and taking steps to prepare is crucial for ensuring a smooth transition and avoiding potential disruptions.

Milestones and Timelines for Romania’s Clearance Mandates

January 1, 2024:

- B2B e-reporting mandate commences: All companies in Romania must begin electronically reporting domestic business-to-business transactions.

January 1, 2024 to March 31, 2024:

- Grace period: This transitional phase allows companies to adapt to the new e-reporting requirements without facing penalties for non-compliance.

July 1, 2024:

- Enforcement commences: Penalties ranging from €1,000 to €2,000 will be imposed on non-compliant large entities for failing to adhere to e-invoicing regulations.

July 2024 onwards:

- Full implementation of e-invoicing mandate: Electronic invoices become the sole recognized format for B2B transactions in Romania.

What’s new in the Romanian tax and e-invoicing model?

Romania’s transition to e-invoicing aligns with a broader European initiative towards modernized and efficient fiscal systems. This movement, driven by legislation like the 2020 adaptation of Directive 2014/55/EU, aims to strengthen tax compliance across the continent. Subsequent Romanian laws and ordinances further refine the structure and enforcement of the e-invoicing system, solidifying its role in this broader European effort.

The core element of the new system lies in two key changes:

- Mandatory e-invoices: As of July 1st, 2024, issuing electronic invoices (e-facturi) will become mandatory for all business-to-business (B2B) transactions in Romania. This means paper invoices are no longer legally valid for these transactions. The system utilizes the RO e-Factura platform, managed by the National Agency for Fiscal Administration (ANAF) and requires businesses to issue and receive invoices electronically in a specific format (UBL 2.1) which is called RO_CIUS (or RO-CIUS) in Romania.

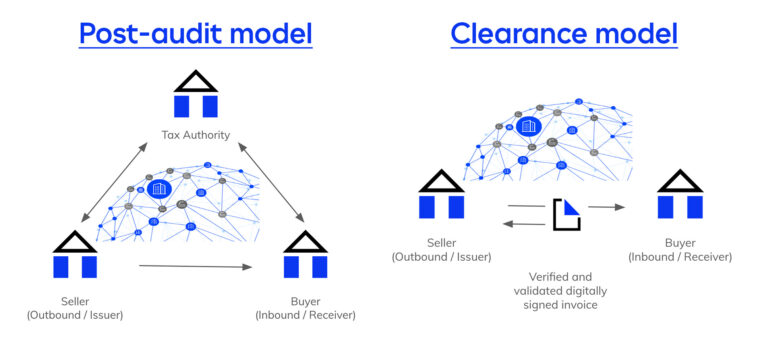

- Electronically issued clearances: Businesses will receive clearances electronically upon fulfilling their tax and social security obligations. These clearances, previously obtained physically from different authorities, will now be generated electronically through the ANAF portal. This also means that the tax collection in Romania moves from a post-audit to a clearance model.

Companies must ensure their current systems are compatible with the RO e-factura platform and can generate compliant electronic invoices. For most finance departments, this shift necessitates an overhaul of existing processes that will typically include the support of accounting and e-invoicing software that integrates with the RO e-Factura platform.

Solutions like Tradeshift Pay help businesses simplify data management, automate e-invoice issuance, and ensure compliance with the new regulations. Companies already using Tradeshift’s e-invoicing and AP automation platform also benefit from our continuous support to stay compliant in all the markets that shift to a clearance system.

Bridging the e-Invoicing Data Gap

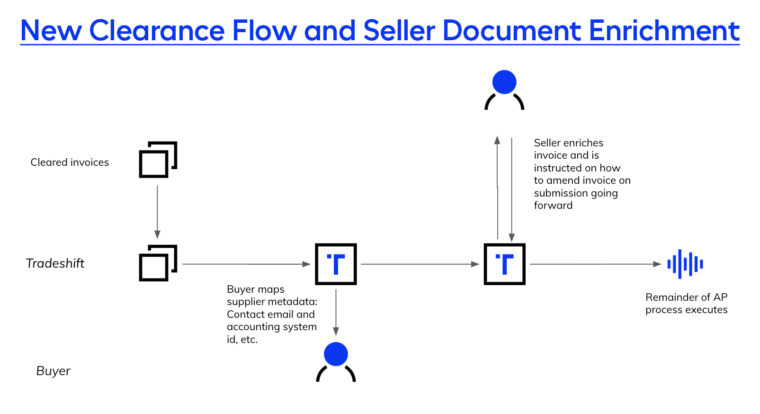

Tradeshift also helps businesses overcome potential data gaps that may surface as they transition to the clearance model. Clearance regimes typically mandate just enough information for tax determination purposes, and Romania is no exception. Left unchecked, the burden to collect and verify any additional information required to process an invoice would fall squarely on the shoulders of your AP team, undermining any efficiency gains they might otherwise expect from the new system.

Tradeshift overcomes this challenge by asking suppliers to participate in the data enrichment process and deploying automation to further streamline the collection and verification of information outside of the mandated fields.

Mission Critical: what you need to do right now

Businesses must register on the RO e-Factura platform and obtain the necessary credentials for issuing and managing e-invoices. If you haven’t done this already, then we strongly advise you to do so right away.

Educate your staff on the e-factura system and the new clearance procedures, including navigating the ANAF portal. Keep an eye on the ANAF website for any last-minute updates or amendments to the timelines and specifications.

Finally, take a step back and look at the bigger picture. What’s happening in Romania isn’t an isolated case but part of a much broader shift towards clearance models that’s accelerating worldwide.

More than 80 countries worldwide have e-Invoicing mandates and a further 50 have announced their intention to impose new or additional mandates. The expectation is that by 2030, most of the world’s 200 VAT regimes will have mandatory continuous transaction controls in place. With no common standard, each country is free to develop its own rules and requirements, so every country’s e-invoicing regime is different.

Monitoring and managing the changes can be daunting for global organisations, highlighting the need for solutions that can centralize and streamline compliance.

Tradeshift has a proven process for delivering compliance-as-a-service, and provides customers such as AirFrance, Disneyland Paris, Schaeffler with innovative solutions that support their digital transformation journey and ensure they comply with e-invoicing and tax clearance mandates.

We currently offer compliance-as-a-service for 70 countries, including a streamlined process for complying with tax clearance mandates in 12 countries and e-Invoicing mandates.

Examples of countries with tax clearance or B2B e-invoicing mandates that we support are France, Romania, Malaysia, and Germany with other European and APAC countries on our roadmap.

To ensure compliance excellence, we continually evaluate emerging global regulations and prioritise the inclusion of additional countries in our roadmap.

We’re also the only company offering cross-zone fapiao e-invoicing capabilities in China and among the first to become a registered PDP (PDP immatriculée) in France.

Start sending and receiving compliant e-invoices with Tradeshift